An

Insurance Premium Tax rise is branded “a raid on the responsible”

With

the standard rate of IPT increased three times between November 2015 and

June 2017, from 6 to 12 per cent, and the ease with which the tax can be collected,

the temptation to continue raising IPT is one where the Chancellor should think

very carefully about unintended consequences - like a rise in uninsured drivers.

That would be both dangerous and costly for both insurers and their customers.

There are some categories of purchase - like most food items and books - where

a zero sales tax is wise for society. Insurance is a prudent purchase and should

not be heavily taxed, if at all.

See the earlier NEWS item on the fuel

duty freeze. More

See our preliminary

review of the Budget 2018 due to be presented by the Chancellor of the Exchequer

on 29th October. More

Posted:

181016

|  | Ahead

of the forthcoming Budget, Ian Quarrington has spotted an article on the Honest

John website where Dan Powell looks at the risk the Chancellor may increase Insurance

Premium Tax yet again.

The article notes Huw Evans, director general of

the Association of British Insurers, has said “The Chancellor has a difficult

task ahead of him in this Budget but he should realise a raid on the responsible

members of society who buy motor and other insurances is the wrong way to balance

the books. People buy insurance because it is a legal requirement .and punishing

these people with another tax rise would be inexcusable. The Association has urged

the Chancellor not to penalise drivers further as he looks to balance the books

in the forthcoming October Budget".

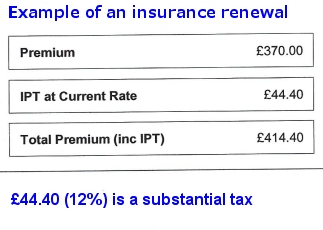

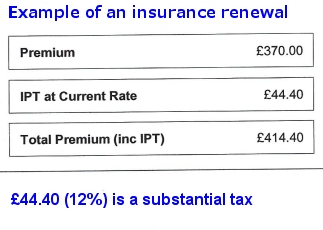

| The

UK has the sixth highest rate of Insurance Premium Tax in Europe since the standard

rate of IPT was increased three times between November 2015 and June 2017,

from 6 to 12 per cent. Insurance Premium Tax applies to all car insurance sold

in the UK and is calculated on the basis of the cost of the individual policy,

which means an extra 12 per cent effectively goes on top of what would otherwise

have been the total cost.

According to the Social Market Foundation (SMF)

think tank, Insurance Premium Tax now raises more revenue for the Government than

beer, wine and spirit duties combined. About half of this is paid directly by

households on insurance products, with the remainder paid by businesses. The SMF

claim that business costs associated with insurance tax are likely, at least in

part, to feed through into the finances of households – through higher consumer

prices, lower dividends and reduced profits for business owners. Its forecasts

suggest that the per-household annual costs of insurance tax will rise above

£200 by the end of 2018. |

|