|

Insurance

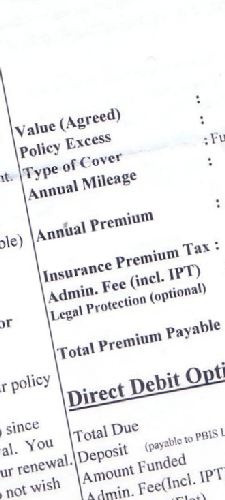

premium tax increase from 4th January 2011

On a typical MGV8 classic car insurance renewal premium, the

IPT increase will amount to less than a pint of beer.

Posted: 18.12.10

Back to homepage

|

|

Insurance

premium tax is due to increase - new standard rate

and higher rate will have effect for premiums received

or written by an insurer on or after 4th January

2011.

The standard rate of insurance premium tax

(IPT) applies to most general insurance, including

property, motor and medical insurance. Life assurance

and other long term insurance products are exempt

from IPT. The increase is from 5 to 6 per cent.

The higher rate of IPT applies to travel

insurance and to certain insurance (e.g. extended

warranties) sold alongside motor vehicles and some

consumer goods. It was introduced at 17.5 per cent

in 1997 to stop VAT avoidance through ‘value-shifting’

between goods (subject to VAT at 17.5 per cent).

An increase in the higher rate of IPT from 17.5

to 20 per cent in line with the increase in the

standard rate of VAT due to take effect from the

same date.

HMRC

note BN19 |

|

|