|

The

last UK-owned volume carmaker is beset by questions about its viability,

says John Griffiths

If,

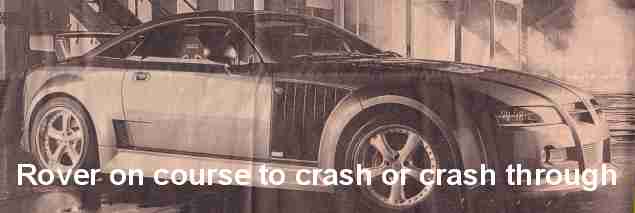

as a lot of industry sceptics still insist, MG Rover is heading

inexorably for a financial brick wall. Britain's maverick independent

car company will hit it at speed and with style.

.

The

first customers are about to take delivery of the MG SV,

a £75,000 Porsche-challenging supercar packing 320 horsepower

from a Ford-supplied V8 engine. This will be followed by another

Ferrari-frightening version with 465bhp. Wave enough extra cash

under the nose of Jim Johnson, director of the Group's MG Sport

and Racing subsidiary and a customer can have up to 750bhp. For

those suffering Concorde withdrawal, a nitrous oxide injection system

has the car nudging 1,000bhp.

. A few weeks ago, on Bonneville salt

flats in Utah, an MG Rover flashed by through the timing lights

at 225mph. An SV undergoing the ultimate "road" test"?

Well no; in fact that one was a souped up version of the Company's

MG ZT-T estate car. Done just for fun, of course . . . .

. Simultaneously with the SV, deliveries

are starting of the MG ZT saloon and estate cars, re-engineered

from the front wheel drive model to rear wheel drive and fitted

with nearly five litres of V8 power. Kevin Howe, chief executive,

makes no secret that its principal target is the best and fastest

that BMW - MG Rover's former owner - can offer.

|

In

short, MG Rover, under a rakish corporate slogan "outrageous

fun for all" is revelling in the reputation it has acquired

since independence as an automotive mouse that roars.

. Its unashamedly macho advertising

campaigns make the Advertising Standards Authority twitch. It

has seriously embarrassed some of the World's biggest car makers on

the track, from the British Touring Car Championship to le Mans. Only

last week it revealed to a wide-eyed Motorsport Industry Association

Conference, a petrol/electric prototype developed in secret with the

UK's Motor Industry Research Association and a project that hitherto

has been the province of big carmakers such as Honda and Toyota.

. So Mr Howe - his own helmet and race

overalls tucked discreetly in a corner of his office after an SV testing

session - sighs wearily when the question is raised yet again as to

whether MG Rover really can survive as a small fish in a car industry

ocean of big sharks prowling ever more ravenously for market share.

. His unequivocal

answer is that MG Rover will indeed get by - albeit with a little

help from Indian and Chinese friends. Critics have been proclaiming

MG Rover's imminent demise almost from the day in May 2000 that John

Towers and his Phoenix consortium of Midlands business handed over

£10 to BMW, |

receiving in return the Longbridge car company, £520m

in ultra-soft loans to keep it going - and control over the destinies

of 5,000 disillusioned and apprehensive West Midlands workers.

. MG Rover confounded critics, says

Mr Howe, by moving the entire production line for the Rover 75 from

what is now BMW's Mini plant near Oxford to Longbridge, with no

loss of quality. It went on to engineer and launch its MG "family"

of cars based on the Rover 75 and the smaller Honda-based 45 and 25

saloons and hatchbacks. Along the way it laid the groundwork for the

SV "supercar" business by buying up Qvale, a US-Italian

luxury sports car maker.

. In November, MG Rover will launch the

City Rover, an Indian-built cheap "super-mini" being

supplied under a partnership with Tata, the Indian conglomerate, which

MG Rover expects to sell at a rate of 40,000 units a year. By the

middle of next year the Rover 75 and MG ZT and other products will

have received facelifts. But the questions about MG Rover's viability

persists, and are inevitable.

. During the three years since independence

Mr Howe and his colleagues have certainly succeeded in cutting the

losses that piled up under BMW. In 1999, the last year of BMW

ownership, what was then the Rover Group chalked up a loss of £786m

(although about £250m of that was accounted for by Land Rover,

sold off separately to Ford). In 2000, Phoenix Venture Holdings, the

parent holding company of |

which

MG Rover makes up by far the largest part, made a loss of £378m.

By 2001 it was down to £187m and in the 2002 statement

to shareholders, issued last week, the loss fell again to £95m.

. But behind the improvement lies

a tale of missed targets. On original calculations, the group

would have broken even in 2002, with the first profits coming in during

the current year. Instead, acknowldeges Mr Howe, there will be another

loss - although smaller again. The improvement at MG Rover, as a carmaker

pure and simple, is also not quite as good as the holding company

figures suggest. The loss on carmaking last year was £111m,

down from £175m a year earlier. Profits from the Powertrain

engines subsidiary and leasing other marginal activities helped Phoenix

as a group.

. But the past year has brought several

setbacks. The collapse of a strategic alliance with the troubled China

Brilliance group, under which the partners would have jointly developed

Powertrains and cars, then shared the global marketplace, has left

MG Rover with the task of bringing to market on its own a desperately

needed successor to its Rover 45/MG ZS range. That process will be

financially painful. MG Rover was also given a head start by BMW in

that production facilities, tooling and development

costs of most of the current cars came

free of charge. |

The

new mid-size car will also save a large chunk of development costs

by using an adapted Rover 75 platform. But the final bill for the

new car will certainly be in excess of £100m.

. The

double whammy

on Rover's medium car project has been the fall into receivership

of entrepreneur Tom Walkinshaw's TWR,

the Oxfordshire engineering consultancy to which development work

on the mid-sized car had been transferred. MG Rover's engineering

staff are still extracting what data and other work in progress they

can via the receivers.

. As a result of these blows, far from

the new car coming to market in the middle of next year, as originally

projected, it is now likely to be at least halfway through 2005 before

it can start generating cash.

. In terms of cashflow at least, MG

Rover has so far kept its head well above water. The Group's cash

balance has remained above £300m for each year of independence,

after meeting all development and other costs. From now on however,

the Company can now longer count on funds from BMW; the third and

final £77m tranche was paid over in 2002. With more than a year

and half to run before the new mid-sized car emerges, and further

development costs still to be paid, MG Rover can no longer afford

another serious reverse, says Prof Garel Rhys, Cardiff Business School's

motor industry expert. "But the China Brilliance episode could

have been far worse", he says. "The company is still cash

positive and should have the funds to |

complete

the new car".

. Mr Howe himself acknowledges that the

drain MG Rover's losses are exerting on the Group's still substantial

cash resources is becoming more uncomfortable, and the need to

start generating profits increasingly urgent. In pursuit of that goal,

"the next two years until the launch of the new medium car will

be a period of rigorous cost and cash controls", says Mr Howe.

Inevitably, exchange rate considerations mean that more of MG Rover's

component purchases are being made abroad - bad news for some of the

400 plus UK suppliers who still account for about 70% of the Group's

annual components and services spend.

. But while a decade or two ago a big

purchasing shift would have been a severe blow to the West Midlands

economy, the steady shrinkage of MG Rover's output - to about 150,000

units from 500,000 - means that few suppliers are overwhelmingly

dependent on what was once British Leyland, then a state owned group.

"Given its history, we've long since learnt not to put all our

eggs in one basket" says one supplier. One widely aired worry

among suppliers when BMW jettisoned MG Rover - its ability to pay

its suppliers' bills - appears to have faded long since. Nevertheless,

the delay surrounding the mid-sized car is leading some to express

apprehension about making any sizable |

investment

of their own in component develop-ment or tooling.

. Mr Howe claims that critics of the

Group are undervaluing a number of positives, not least that a

long sales slide appears to have been arrested. MG Rover had total

sales last year of 140,00, down from 170,000 a year earlier. This

year's sales are running at close to last year's level, however, even

before the Tata-built CityRover goes on the market next month. Of

last year's sales, all but 7,000 were within the UK and continental

Europe. So this year the Company has been entering or re-entering

a number of markets, including Japan, Mexico and New Zealand.

. There are several other initiatives

under way; negotiations are continuing with Tata on how the partnership

might be broadened to take in other vehicles, and an agreement with

Phoenix, MG Rover's parent, to distribute Tata vehicles has already

been concluded. Insiders say a pact with another Chinese partner,

allowing MG Rover to share vehicle development and gain access to

China's new car market, is also claimed to be in the final stages

of negotiation.

. With profits coming from the Powertrain

engine business, and the prospect of expanding its XPart and AutoService

Centre, senior executives argue that there is no reason to think MG

Rover will not survive.

The sharks, meanwhile, can afford to circle and

wait.

This article

first appeared in the Financial Times on Wednesday 29th October 2003.

It is reproduced here with the kind permission of the author John

Griffiths (30.10.03). |

"Two years until the launch of the new medium car will be

a period of cost and cash controls" - Kevin Howe, Chief Executive,

MG Rover. (Photo: FT)

Banner

photo - the new MG SV. John Griffiths says "I have rarely

known a car - outside the Avantime VelSatis - to divide opinion so

completely on looks. I'm afraid I regard it as a genius, brutal piece

of styling differentiating it from the supercar pack like few others".

(Photo: FT)

Footnote

10th January 2004: Subsequently

MG Rover has seen the launch of the new Rover City model but has unfortunately

suffered badly from adverse publicity of a senior management benefits

package, with reduced sales volumes.

The launch of the MG ZT 260 V8 in both saloon and estate versions

has been very well received by the motoring press. |

|