End

of the fuel duty cut and freeze

In the Chancellor's Autumn Budget 2025 statement yesterday she announced

the end of the 5p cut and the revival of the annual RPI increase in

the rate of fuel duty.

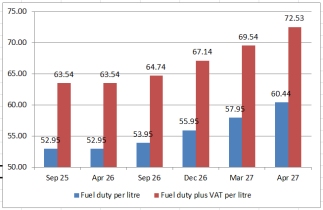

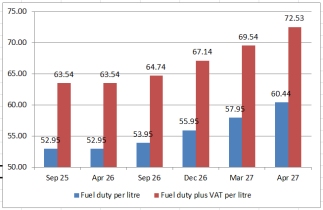

Full size charts available. Link

Posted: 251127 |

Fuel duty

rates before and after VAT is added

|

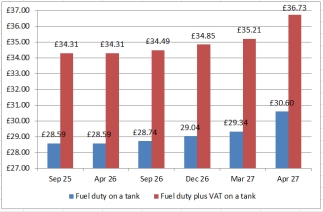

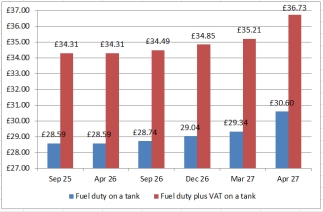

Cost of

fuel duty for a tank of unleaded before and after adding

VAT |

Fuel

Duty freeze

The Chancellor confirmed in her Autumn Budget 2025 statement

that fuel duty freeze, which has been in place since 2011, will

remain until the end of August 2026. After this point, the five

pence cut, first brought in back in 2022 to help ease the burden

of exceptionally high fuel prices on drivers at that time, will

be reversed in a "staggered approach". A 1p increase

on 1st September 2026, a 2p rise on 1st December 2026 and another

2p rise on 1st March 2027. The planned inflation increase for

2026-27 to fuel duty will not take place but the Government

will be uprating fuel duty rates by the Retail Prices Index

(RPI) from April 2027.

Removing the 5p cut in fuel duty was expected but the

return of the RPI annual increase on fuel duty was a

slight surprise. The charts above show how the fuel duty will

rise from now until April 2027 and the costs of fuel duty in

a full tank of unleaded petrol in an MGBGTV8. I think there

were clear signs the fuel retailers had not been passing on

that 5p cut although to be fair some were and their prices were

attractive. The present fuel duty rate of 52.95p/litre or 63.54p

with VAT included is a major 47% slice of the cost of a litre

of unleaded fuel at say 134.9p/litre. That's around £35

of fuel duty and VAT on an MGBGTV8 tank of £73.

|

|