Push

to reduce VED exemption to a rolling 30 years

Comment

Whilst classic car enthusiasts with cars from the early 1980s and

early 1990s (many "hot hatchbacks") would welcome the 10

year reduction in the rolling VED exemption, with the present difficulties

the Chancellor of the Exchequer faces in dealing with the huge debt

built up to provide various packages of support during the Covid pandemic,

giving away a greater road tax exemption concession is the last thing

he would want to consider! The comments alongside from Sir Greg Knight

MP (chairman of the all-party Parliamentary Historic Vehicles Group)

shortly after the launch of the petition in May are clearly code

for "don't push your luck!"

Updated: 210610

Posted: 210520

|

|

Update

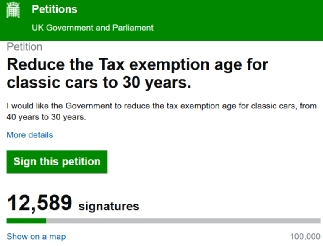

30 year VED exemption has over 12,000 supporters

The campaign behind the petition calling for the rolling 40

year exemption for "Historic" vehicles from vehicle

excise duty (VED or road tax) to be reduced to 30 years is reported

to have attracted more than 12,000 signatures on a UK Government

petitions website.

Government responds to all petitions that get more than 10,000

signatures - so the campaigners are waiting for the response,

usually in 7 days. For petitions that reach 100,000 signatures,

they will be considered for debate in Parliament. With the present

difficulties the Chancellor of the Exchequer faces in dealing

with the huge Covid support debt an

extention to the VED exemption seems very unlikely. |

|

Over

5,000 enthusiasts have signed a petition calling for the rolling

40 year exemption from vehicle excise duty (VED) to be changed

to a rolling 30 year exemption. That change would reach classic

cars built in the early 1990s. The aim of the campaign is to

lower the the cost for younger enthusiasts keen to own a classic

car, particularly cars from the 1980s which are not included

in the present 40 year rolling exemption. The campaigners are

not seeking to also have a MOT exemption in the call for the

30 year rolling VED exemption. In fact the campaigners say "all

cars should undergo a safety check and that MOTs are are important

to ensure the vehicles are roadworthy". They add a "change

in the road tax exemption for classics to 30 years would be

a boost for the retro car market".

However Sir Greg Knight MP (chairman of the all-party Parliamentary

Historic Vehicles Group), urged campaigners to reconsider as

"any attempt to persuade the Government to change the

current VED exemption for Historic vehicles needs to be approached

with caution whilst we are still recovering from the Covid pandemic".

He adds "the Chancellor of the Exchequer is already

facing a Budget shortfall as a result of the heavy costs of

the support provided as a result of Covid so asking him

now to forgo more revenue form VED receipts is not something

that is likely to be welcomed in Whitehall". That's

code for don't push your luck! |

|