| DVLA

has launched a new advertising campaign in 11 areas around the country

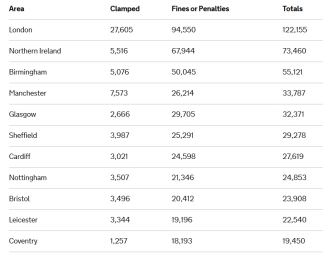

clamping drivers who haven’t taxed their vehicles New DVLA stats released earlier in the week show that over 460,000 vehicles in 11 cities nationwide are clamped or fined yearly for failing to tax their cars. Back in 2014, the DVLA removed paper tax discs, saying that an online database was a more cost-effective way forward, saving the Treasury around £10 million a year. The lost revenue from the higher number of people not taxing their cars is predicted to be over £100 million, which is going to be a quarter of a million a year lost on average. Since 2014, experts estimate the number of people not taxing their vehicles has increased by 28%. See report in November 2017. Care with VED exempt classic cars Even if your MGV8 is road tax exempt you are still required to renew your road tax annually at the "NIL value" VED rate. Each renewal is added to the GOV.UK vehicle database which the APNR (Automatic Number Plate Recognition) technology used by the DVLA clamping team and police use to check the current road tax status of cars on public roads. Motorists can go online, 24 hours a day, to tax a vehicle or check whether their vehicle tax is up to date. You can even check by asking Amazon Alexa or Google Home – all you need is your vehicle registration. Check if a vehicle is taxed now. Check Checking VED, MOT and insurance status for your car. More Posted: 190228 |

| ||||