New

disclosure rules for insurance renewals

For further information

on the new FCA conduct of business rules introduced recently which come into force

from 1st April 2017.

Freshfields

Bruckhaus Deringer

Bond

Dickinson

The introduction of these new FCA requirements was mentioned

in a report to the Club's Council meeting on Saturday 11th March 2017 by Peter

Best.

For the avoidance of doubt, no part of this NEWS item is formal

advice with regard to motor insurance, simply a report of a development due to

come into force in a matter of a few weeks as it is surprising it has not received

much news coverage.

Posted:

170312 |  | A

mandatory change affecting insurance comes into effect from 1st April 2017. From

that date all insurers, and presumably brokers too, have to include in communications

to their customers concerning the renewal of their insurance cover a statement

explaining customers should shop around to ensure they get the best deal.

| The

Financial Conduct Authority (FCA), the conduct regulator which covers the

insurance sector, has been concerned that the way in which insurance policies

are priced at renewal may result in poor customer outcomes. Customers may not

understand the price they are paying for their renewed policy, and longstanding

customers may pay more than new customers for the same product due to this lack

of understanding and their inertia when it comes to shopping around at the point

of renewal. In December 2015 the FCA published a consultation on new rules and

guidance to tackle these issues. Their policy statement contains new rules that

will be added to the Insurance: Conduct of Business source book (ICOBS) from 1st

April 2017.

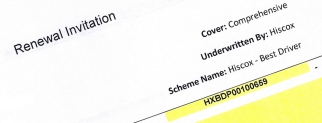

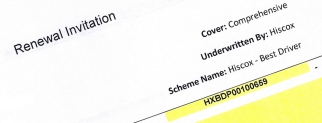

Notice to be issued with insurance renewals

Firms

proposing to consumer the renewal of cover are now required to encourage consumers

to consider shopping around for alternative cover. The firm must provide the information

set out below to the consumer in good time before the renewal of the policy.

Presentation

of new premium

The firm must provide the proposed premium to be paid on

renewal in good time before the renewal of the policy.

Presentation

of historic premium information

The firm must also provide either:

>

the premium paid by the consumer at the start of the policy; or

> where

one or more mid-term changes were made to the policy which the firm proposes to

renew, an amount calculated by annualising (or otherwise adjusting as appropriate

to the duration of the proposed policy) the premium in effect following the most

recent mid-term change, excluding all fees or charges associated with those mid-term

changes.

Comparison

invitation

The customer must also be provided with a statement

>

inviting them to check that the level to be provided by the cover is appropriate

for their needs, and

> reminding them that they can compare prices and

levels of cover offered by alternative product providers.

Comment

The

aim here is to ensure the customer will be aware of the historic premium information

so they can compare that with the renewal premium on the papers they receive from

the insurer or broker and see the extent of any increase or decrease in the premium

payable.

During an item on a BBC R4 programme this week it was said that

in the energy market the regulator wants to introduce measures to try and make

all energy suppliers offer their cheapest tariffs to all customers and not just

to new customers (to attract them) or to existing customers who contact their

existing supplier and seriously haggle for a better rate. Analysis suggests the

loyal customers who do not search

for better tariffs are paying higher energy prices and it is that increase in

their energy price which is subsidising the discounts offered to new or churning

or haggling customers. Clearly that business model regards loyal customers as

"stuffees"! It seems the motive behind the insurance "renewal statement"

in the new FCA rules above for the insurance sector is based on a similar concerns.

Classic

car insurance is specialised sector of the motor insurance market where the scope

and quality of the policy is important rather than simply price. Limited mileage

and agreed value conditions help reduce the premium payable but other features

of the scope of the policy are important with classic car policies - free European

cover, breakdown cover in the UK and in Europe and factors like how well the insurer

or broker handle claims. Hopefully that experience will be rare if at all but

when you need support with a claim then the quality of the support will become

a very important feature in the policy. Multi-car policy features are also a feature

too where both your daily driver car(s) and your classic car(s) are either covered

by one policy or covered by some other beneficial multi-car cover arrangement.

On

renewing a classic car insurance cover it's well worth making sure the type

of use you put the car to is covered. Many insurers exclude commuting for

instance and competitive use as well, although low-key events may be covered by

some policies. |

|