Petrol

prices in 2017 - predictions from the petrol prices monitoring website - petrolprices.com

Find the lowest UK petrol price in your area with their regular

emails with local fuel prices from PetrolPrices.com. More

Update

OPEC

confounds skeptics and agrees first crude oil production cuts in 8 years. It was

a broader than expected agreement to include non-OPEC countries. Benchmark crude

oil prices climb to top US$50. Forecourt petrol prices in the UK rose but are

today now around 114.9p/litre having reached 115.7p near the end of November according

to the online petrol prices monitoring website. There is another OPEC meeting

on 9th December 2016 so further details of what is a complicated agreement between

producer countries may be revealed then and impact prices. See Bloomberg Markets

report. More

Update: 161208

Further update

Reports

say that over the weekend OPEC managed to convince a number of non-OPEC producers

to participate in crude oil production cuts. That news sent crude oil prices higher

with worrying forecasts. The underlying aim of the OPEC move is to restore the

balance between demand and supply and to lift crude oil prices. Some forecasts

suggest crude will reach US$60 by the year end and possibly US$70 by mid-2017.

Update: 161213

|  | In

its petrol prices review for 2017 the prices monitoring website petrolprices.com

says "predicting petrol prices in an increasingly unpredictable world isn’t

an easy thing to do! However, that doesn’t mean we cannot try.

As we head into 2017, it’s inevitable that we’ll wonder what the new

year may have in store for motorists". Predictions

See

our earlier petrol prices news items:

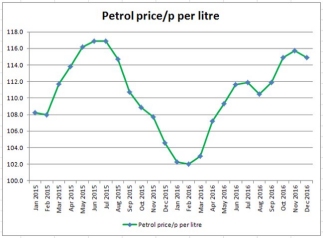

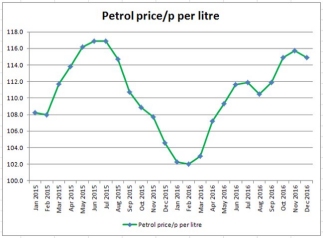

UK petrol prices over the last two

years. More 161125

How

much will higher prices cost you? More

161213

Find

the lowest UK petrol price in your area

You can get regular emails from

petrolprices.com with local fuel prices. More | Winter

2017 (January – March)

They

say "after seeing petrol prices shoot up in December, we think it’s

likely there may be some stabilisation as we head into the New Year, particularly

by the end of January – when the world will be watching the inauguration

of President Donald Trump. Once

Trump takes the keys to the White House, there’s a strong possibility

that there will be downward pressure on the oil price, which will hopefully

lead to falling petrol prices. While time will tell exactly what kind of projectionist

decisions Trump makes, a pro-fossil fuels and pro-fracking president is likely

to want to boost national production, which could put pressure on OPEC and other

nations to lift their production caps to compete. While it’s impossible to

predict how financial markets will react, there’s also a chance the Dollar

will fall once Trump takes office. If it does, this could also contribute to cheaper

consumer fuel in the UK.

Spring 2017 (March – June)

They

say "the end of March is Theresa May’s target date for invoking Article

50 to begin Britain’s withdrawal from the EU. As such, it’s likely British

eyes will turn away from the US and back to more local matters by the time the

clocks change! It’s almost impossible to predict what will happen to petrol

prices around the invocation of Article 50. Spring will also be time for another

budget – the last before the spring budget becomes the “Spring Statement.”

With all eyes likely to be firmly on Brexit, another fuel duty freeze seems

most likely at this point".

Predictions

towards the year end

They conclude with "2017 is going to be another

difficult year for fuel prices with many significant events taking place

that could impact costs – upwards or downwards. While

it seems highly unlikely that we’ll see extremes of pricing near the 145

pence per litre levels of 2012, we do expect petrol prices to reach between

120-130 pence per litre at certain points in 2017".

Posted:

161229 |

|