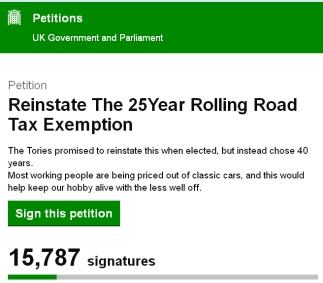

Petition

for a 25 year rolling road tax exemption

The response from

MG Car Club office in Abingdon was "anything that makes owning classic

cars more affordable can only be good - we'd be happy to support that." The

TR Drivers Club don't think it's a terribly great idea, with the economy

the way it is, we need to keep pumping our money into taxes - cars from the 80s

and 90s are generally better made, so there's more left anyway". The stance

of the Federation for Historic British Vehicle Clubs is the definition

of a classic car should be 30 years to fall in line with FIVA and UNESCO guidelines,

so they remain neutral on Government fiscal policy".

See the lead

article on this petition in this week's issue of Classic Car Weekly, a

newspaper for classic car enthusiasts with news, features and auction reviews

plus many adverts for classic cars for sale. It's at your newsagent every Wednesday!

What

are the typical costs and tax & duties paid for running an MGV8? More

Updated:

160214 & Posted: 160203 |  | An

online petition to consider reintroducing the original 25 year rolling road tax

exemption has taken off on the Government website

gathering more than 15,000 signatures in just a few day. It's heading for the

100,000 when the petition will be considered for debate in Parliament. The petition

was launched by Logan Walker, a classic car enthusiast in Kilmarnock in Scotland.

The

original 25 year rolling exemption was removed by the charismatic Gordon Brown

shortly after the Labour party came to power in 1997 and seemed lost for ever.

But following some subtle but effective lobbying by the FBHVC, a VED exemption

was reintroduced quietly in the 2013 Budget by George Osborne. That was later

quietly converted into a rolling 40 year VED exemption in a subsequent Budget.

Both steps have been welcomed by classic car enthusiasts in the UK. The

proposed revived 25 year exemption would see cars from the early 1990s eligible,

so would soon reach MG RV8s! | Comment

The enthusiasm for the petition is understandable because owners of classic cars

which are 5 to 10 years away from eligibility under the present 40 year rolling

exemption are naturally keen to share the same benefit but the success the FBHVC

has had on behalf of the classic car movement over recent years has been achieved

by quiet, subtle lobbying arguing the economic benefit the classic car sector

brings to the UK economy in many ways. Concessions have been quietly released

in simple paragraphs in the HM Treasury's support document for the Budgets. In

times of belt tightening and austerity in the public sector tax concessions, particularly

when they involve pleasures, are not easy to win and can so easily be removed

as we saw in 1997 with the hard hearted Gordon Brown. So keeping a low profile

on campaigning for further road tax concessions with a good economic case quietly

promoted would be a far wiser approach - unintended consequences can always pop

up if a cause has a high profile. The "Green lobby" has already raised

the emissions topic and the need to ban classic cars from urban areas. Clearly

V8 enthusiasts would like to see the road tax concession available to RV8s but

a loud campaign could backfire. |

|