Investment

activity in the classic car market

continues to lift prices

HAGI™

or Historic Automobile Group International is an independent investment research

company and think tank with specialised expertise in the rare classic motorcar

sector. Their website says "the group has created benchmarks which track

this alternative asset class accurately for the first time, using rigorous financial

methodology usually associated with more traditional investments." The HAGI

Top Index is published on the Financial Times website. More

Why are alternative investment activity price pressures a concern for

classic car enthusiasts?

If you have a classic car and have reached the

stage where you are thinking of selling up then the price increase is very welcome!

However with a classic car like an MGBGTV8, which has for so many years been seen

as an undiscovered classic available at very reasonable and affordable prices,

it is already being written up in various classic car magazines and motoring sections

in the national press as a classic car to buy - limited production run, V8 power

and very attractive prices when compared with the usual "classic car cherries"

like Jaguars and Astons. But as prices rise the MGBGTV8 will become less affordable

for an enthusiast and buyers with deep pockets or funds to place in "attractive

alternative investment markets" will appear.

Would the character of the V8 Register as an enthusiasts' group then begin to

change?

Posted:

150809

|  | Our

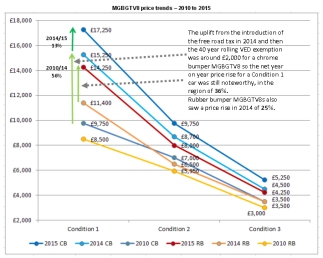

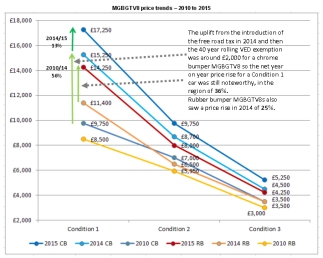

updated price guide for MGV8s released in February 2015 indicated prices had moved

ahead from our previous price reviews in 2010 and 2014. The welcome return

of the road tax exemption for early MGBGTV8s clearly gave prices a lift and

as a rolling 40 year exemption it will continue to work its way through the rubber

bumper models. For Condition 1 MGBGTV8s that rise of £7,500 was from £9,750

to £17,250 although around £2,000 was from the VED exemption saving

effect, so a net rise of £5,500 (56%) in five years. Sadly it will be another

18 years before the VED exemption will reach the RV8 models in 2033.

The

major factor lifting classic car prices over recent years has been the increase

in investor activity where classic cars are seen as "alternative investments

coming of age – with many having their fortunes plotted much like stocks

and shares." In today's issue of the Mail

on Sunday, Toby Walne explores options for spreading your investment risk

and sees how they compare with traditional equity markets.

The chart alongside

shows the comparative growth rates of alternative investments with the HAGI Top

50 Index for classic cars showing a 170% growth since 2010. On the HAGI website

their Top ex P&F Index (designed to measure the rare collector's automobile

market outside the marques Ferrari and Porsche) shows a 7.55% "year to

date" growth although a 1.6% fall in the month. | Alternative

investments chart - gold is seen as a safe haven but in recent times has lost

some of its lustre with falling, stamps have followed the FTSE All-Share index

and wine investors have been losing money. Classic

cars rose.

Chart above source: Mail on Sunday,

150809

Affordable

Classics Index

Chart

source: Hagerty website

| On

the Hagerty website they have an Affordable Classics index which is the

nearest covering cars like the MGBGTV8.

Affordable Classics: Index of

collectible cars priced under US$30,000 (£19,355)

Their "Affordable

Classics" group includes the Datsun 260 Coupe, Ford Mustang Coupe, Triumph

TR6 and the MGB Roadster. Their expert commentary says "while the top of

the market is exercising restraint, buyers at the lower tiers of the market are

more optimistic. For the first time since we began tracking collector car values

in 2006, Hagerty’s Affordable Classics Index was the most assertive mover

of all seven of our primary market indices. The 7% climb since January 2015

is this group’s biggest move on record. It was pushed by a massive upward

correction for Karmann Ghias and several large private sales for 240Zs. The Ford

Mustang, Studebaker Avanti and Buick Roadmaster all notched up sizable gains."

|  | How

did MGBGTV8 prices move over 2010 to 2015?

Our price review prepared by

Adam Fiander released in February 2015 showed a major price increase over that

5 year period, partly as a result of the value of the annual road tax saving

following the Government's very welcome reintroduction of the rolling 40 year

VED exemption. The chart

alongside from our our price review in February 2015 illustrated that very well.

See our price guide and reports. More

Where

are MGBGTV8 prices now?

If you assume prices of Condition 1 cars have followed

the trend indicated by the HAGI and Hagerty indexes then a 7% rise would take

prices for chrome bumper tax exempt cars from £17,250 to just under £18,500

and Condition 2 probaly to near £10,500. The rubber bumper prices on that

basis might be near £15,150 and £9,350. |

|