Full details of the Spring Budget 2017 measures announced are available on the HM Treasury website released following the Chancellor's statement to Parliament. HM Treasury Spring Budget 2017 document. More HMRC Spring Budget 2017 documents. More | Spring

Budget on Wednesday 8th March 2017 The Spring Budget 2017 made in the House of Commons by the Chancellor of the Exchequer, Philip Hammond, on Wednesday 8th March 2017 provided an update on the Government’s plans for the economy based on the latest forecasts from the Office for Budget Responsibility. These forecasts are published alongside the Budget Statement. Full details of those announcements are available on the HM Treasury website & Budget statement. The Chancellor announced in the Autumn Statement 2016 that the Government will move to a single fiscal event each year so the Spring Budget 2017 will be the last Budget held during springtime. The OBR will continue to make two forecasts a year. The Finance Bill will follow the Spring Budget 2017. Following the Chancellor's statement to Parliament we have our usual a prompt report on the few measures announced which will be of interest to the classic motoring enthusiast. See extracts from the HM Treasury document. More | Headlines

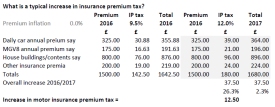

for classic car enthusiasts Fuel Duty - the fuel duty rise expected in 2017 has been cancelled.That means no rise in fuel duty for the 7th successive year. The average motorist will save £130 from this fuel duty increase freeze. Insurance premium tax - the tax rate will rise from the current 10% to 12% from June 2017. In the Budget 2016 in March the rate was increased from 9.5% to 10% so a combined increase of 2.5% in 2016! Vehicle Excise Duty rates and bands - no change to the VED rates other than the RPI increases announced in the Budget last year. VED rates have increased in line with inflation since 2010. More VED rates for cars registered before March 2001 The RPI increases have lifted the rates for engine size up to 1549cc by £5 to £150 for 2017/2018 and by £10 to £245 for over 1549cc like an RV8. Vehicle Excise Duty classic vehicle exemption - no change to the rolling 40 year VED exemption announced at the Budget 2014. |

| See

our previous reports on: Budget statement in November 2016. More Budget statement in March 2016. More Preview of the Spring Budget 2017 See our preview. More & More House of Commons website. More | Rolling

40 year VED exemption guide Updated flowchart & More Original VED exemption guide | What

is a typical increase in insurance premium tax likely to be in 2017? See our worked example. More  |

| Updates

and comments See our recent news item on the emissions zones in London. More | Increased

VED weighting for diesel engined vehicles? Victor Smith commented "I had expected a shift in the VED rates for new cars with an increased weighting on diesel engined cars but so far as I can see VED rates continue to be based on CO2 emissions (g/km) and they have simply had the RPI increases applied and then set out in the HMRC Policy Paper. I think the Government seems to have decided to tackle air quality by leaving it to local authorities to introduce emissions zones and congestion charges rather than try and tackle that through differential VED rates. It's also a good way of avoiding any public annoyance with Government through raised taxation (VED) but playing on the virtue of passing the power to deal with such matters to local government. Personally I feel that is the right way to handle the diesel engine and particulates problem." Chris Hunt Cooke responded saying "according to a report in the Times, in his budget speech yesterday, Philip Hammond failed to address the issue of air pollution or diesel emissions head on, prompting criticism from environmental groups. However, documents published by the Treasury suggested that it would be tackled in the Autumn Budget, to be delivered by the end of the year. The Government has already committed to publishing an air-quality plan by April to cut emissions in the most polluted sites, with the possibility of new charges on polluting vehicles. Yesterday the Treasury said that the Government would “continue to explore the appropriate tax treatment for diesel vehicles” alongside the air-quality plan. It is due to consult motor industry leaders on the proposals over the summer before publishing details in the Autumn Budget. Motoring groups warned that any increase in taxes would almost certainly lead to the death of diesel vehicles, despite claims from the industry that the latest generation of cars are far cleaner than older models".Chris adds it's my bolding of the text above as I do not know to which documents they refer.Rolling 40 year VED exemption for classic cars Victor Smith noted "the rolling 40 year VED exemption is not mentioned so far as I can see so we assume it continues to roll although I recall that when the 40 year exemption was introduced and went through in the Finance Bill for that year it was worded in a way which would require the annual roll forward to be included in future Finance Acts". Chris Hunt Cooke responded "the Finance Act 2016 enshrined the 40 year exemption as a rolling exemption from 1st April this year, instead of the previous year on year extension, so it would now require positive legislative action to stop it rolling forward. The relevant provision reads: 151 VED: extension of old vehicles exemption from 1 April 2017 (1) Paragraph 1A of Schedule 2 to VERA 1994 (exemption for old vehicles) is amended as follows. (2) In sub-paragraph (1) for the words from “if” to the end substitute “during the period of 12 months beginning with 1 April in any year if it was constructed more than 40 years before 1 January in that year.” (3) . . . . . . . . . . . . . (4) The amendments made by this section come into force on 1 April 2017." | |

| Posted: 170308 @ 1345 Updated: 170310 | V8 Register - MG Car Club - the leading group for MG V8 enthusiasts at www.v8register.net | |